| |

| Mobility Solutions |

Right from assisting an individual in carrying out routine activities to acting as a source for entertainment, smartphones has something in store for all. In the recent times smartphone has influenced millions of people worldwide. While some users consider it as a PDA, others use them to engage in mobile commerce and avail on the go services.

Through your mobile now you can make payments, transfer funds, buy products, communicate and access information. Mobility solutions offers specific apps to address every commercial activity whether it is banking, insurance, investments, loans or credit cards.

Mobility Solutions Influencing Insurance Sector

Have a look at the insurance sector for example, it uses mobility solutions to provide services across several avenues. For both the agents and the policyholders the services offered on the mobile medium ensures maximum convenience. One could use the mobile insurance solution interface for carrying out several important insurance tasks and activities.

Through the app interface you can file and submit claims, attach supporting documents, pay premiums and settle out other dues. Using the mobility solution customers are allowed to access their account, schedule payment date, renew policy and file claims using their smartphones or tablets. Many insurance mobility solution also provide an online access to the grievance redressal cell to let the insured submit their complaints/feedback.

Tie-ups with Corporates

Many corporate nowadays are actively participating and enrolling for several insurance programmes to benefit their employees. Several individual and group policies are offered to cover health problems, injuries and to encourage learning.

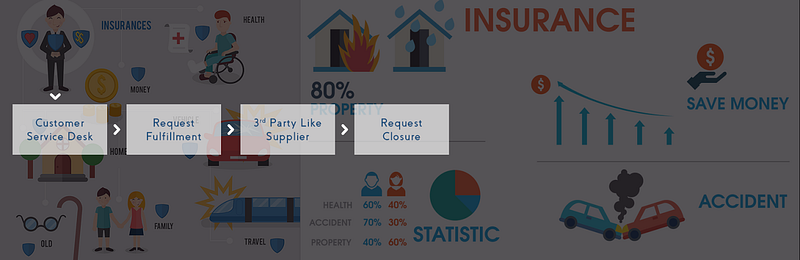

Corporate users use mobile insurance application to interface on the help desk portal and communicate concern on live call support. Usually a unique ticket is generated in the system, whenever an issue or concern is raised by the user. Depending on the type and complexity of the concern, the system assigns it to appropriate executive at a certain level.

The handling executive analyzes the problem and resolves them, at times they even escalate them when seem necessary. After having resolved the issue, the executive is responsible to close the ticket within the prescribed time frame. Given below are the highlights of the insurance mobility solution process for problem management and tracking.

Highlights of Insurance Service Request Management

Provides single platform for registration of all service requests/complaints received via different channels

- Acknowledges with unique ticket reference no. along with SLA information

- Smartly routes service requests to appropriate department/individual for resolution

- Automatic parses inputs received via email or social network to identify request type

- Provides 360 degree view of customers’ details to CSR, ensuring informed and faster query resolution

- Monitors service request & complaint management process, ensuring improved operational efficiency

Summary

Without the appropriate customer request addressing system in place, agents find themselves unequipped leading to dissatisfaction and service delays. In this fast paced world, it is need of the hour to have an efficient mobile system that provides e-application and straight through processing for faster turnaround time. With this approach of processing can enhance the efficiency of agents and improves the overall customer experience.

LetsNurture is a web and mobility solution provider that promises to help startups and SMEs from diverse sectors. Do you want to give your business a mobile presence? — We are here to assist. Email us on enquiry@letsnurture.com

No comments:

Post a Comment